Let’s be real, teaching kids about money can feel like a daunting task. Between allowance, piggy banks, and understanding the value of a dollar, it’s a lot to navigate! But setting your children up with good financial habits early on is one of the greatest gifts you can give them. It’s about more than just squirreling away coins; it’s about understanding financial literacy, setting goals, and making smart choices. If you’re wondering what the best way to save for kids truly is, you’re in the right place. We’re going to dive into some fantastic tools and strategies that make learning about money engaging and effective.

Why Teaching Kids to Save Matters More Than Ever

In today’s world, where digital transactions often obscure the physical exchange of money, it’s crucial for kids to grasp financial concepts. Learning to save isn’t just about accumulating wealth; it’s a foundation for understanding budgeting, delayed gratification, and the importance of financial security. Instilling these money habits early can empower them to manage their own finances responsibly as adults, setting them on a path toward future savings and independence. From a simple piggy bank to understanding investment principles, the journey starts with you, the parent.

We’ve scoured the market for a mix of resources – from interactive money tools to insightful books that help parents communicate complex ideas effectively. Here are 7 top picks to help you find the best way to save for kids in a way that resonates with your family.

How to Talk So Kids Will Listen & Listen So Kids Will Talk

This classic parenting guide might not seem like a direct savings tool, but hear us out! Effective communication is the bedrock of teaching any important life skill, including financial literacy. When you can truly connect with your children, understand their perspectives, and articulate your own, explaining concepts like saving, spending, and giving becomes infinitely easier and more impactful. This book empowers you to foster an open dialogue where kids feel heard and are more receptive to learning valuable lessons about money and beyond.

- Key Features:

- Paperback format

- Practical advice on communication techniques

- Real-life examples and dialogues

- Strategies for addressing common parent-child conflicts

- Pros:

- Improves overall parent-child communication

- Provides tools for discussing difficult topics

- Helps build stronger family bonds

- Long-standing reputation as a valuable parenting resource

- Cons:

- Not directly about financial education

- Requires consistent effort to implement

- User Impressions: Parents consistently praise this book for its transformative impact on family dynamics. Many highlight how it helps them navigate challenging conversations with empathy and effectiveness, creating a more harmonious environment where children are more open to guidance on all subjects, including money management.

- See it on Amazon here

How to Talk so Little Kids Will Listen: A Survival Guide to Life with Children Ages 2-7

Tailored specifically for parents of younger children, this book is a fantastic resource for laying the groundwork for future financial discussions. Learning to save starts early, often with simple concepts like waiting for a desired toy or understanding that money is earned. This guide offers practical, age-appropriate strategies to communicate effectively with toddlers and preschoolers, making it easier to introduce basic money principles without frustration. It’s about building a foundation of understanding and cooperation, which is crucial when embarking on the journey of teaching the best way to save for kids.

- Key Features:

- Focuses on communication with young children (ages 2-7)

- Offers actionable strategies for common challenges

- Illustrated examples for easy understanding

- Written by experts in child development and communication

- Pros:

- Helps parents connect with young children effectively

- Provides practical tools for everyday situations

- Reduces power struggles and promotes cooperation

- Lays groundwork for future complex discussions like money

- Cons:

- General parenting advice, not solely financial

- May require adaptation for specific family dynamics

- User Impressions: Reviewers rave about how this book makes parenting younger children significantly less stressful. They often comment on how the techniques help them manage tantrums, encourage sharing, and explain concepts in a way little ones can grasp, proving invaluable for setting positive behavioral and learning patterns.

- See it on Amazon here

How to Turn $100 into $1,000,000: Earn! Invest! Save!

Now this is a book that directly tackles financial education for kids, making it an excellent component of the best way to save for kids strategy! This engaging book demystifies the world of money, explaining key concepts like earning, investing, and saving in an accessible way for young readers. It’s not just about hoarding cash; it teaches children how money can grow and work for them, moving beyond the simple piggy bank concept to more sophisticated wealth-building ideas. It’s a fantastic primer for entrepreneurial-minded kids and those looking to understand the bigger picture of financial management.

- Key Features:

- Focuses on earning, investing, and saving

- Presents complex financial ideas simply

- Aimed at school-aged children and young teens

- Promotes an entrepreneurial mindset

- Pros:

- Directly teaches financial literacy

- Inspires children to think about wealth creation

- Provides practical steps for money management

- Helps set long-term financial goals

- Cons:

- Concepts might be advanced for very young children

- Requires parental guidance for deeper understanding

- User Impressions: Parents and educators frequently recommend this book for its ability to make finance fun and understandable. Kids reportedly get excited about the idea of growing their money, and many parents note that it sparks valuable family conversations about future financial goals and smart money habits.

- See it on Amazon here

Mczxon Wooden Give Save Spend Money Saving Box for Kids, Piggy Bank for Boys Girls,…

This isn’t just a piggy bank; it’s a brilliant money management system designed to teach kids vital financial lessons from a young age. The Mczxon Wooden Give Save Spend Money Saving Box clearly divides funds into three crucial categories: “Spend,” “Save,” and “Give.” This tactile, visual approach makes abstract budgeting concepts concrete and easy for children to grasp. It’s an excellent hands-on tool that makes learning the best way to save for kids an interactive and empowering experience, encouraging responsible spending, diligent saving, and thoughtful generosity.

- Key Features:

- ❤️Save Spend Give Giggy Bank System: One piggy bank for boys or piggy bank for girls with 3 compartments labeled Spend, Save, and Give for spending, saving and giving to teach your child about budgeting, setting savings goals and the Give section encourages kids to give (help others) from a young age

- ❤️Helps Develop Smart Money Skills: This piggy bank for kids is designed to help kids develop long-term smart money habits and goal-setting skills in a fun way. Like budgeting, goal setting, and tracking spending.

- ❤️Easy to Use: Both the top wooden panel and the side acrylic panels can be opened. Children can count or move funds between the compartments.

- ❤️Clear Coin Bank Jar: The large child piggy bank is made of durable acrylic and wood material. Through the clear surface, We can clearly observe the growth of savings. Slot Size:1.78″L X 0.23″W , They can easily deposit their allowance, both coins and folded bills.

- ❤️Meaningful and Practical Gift: This childrens piggy bank is a great educational tool for kids, teens, boys, girls to teach your children about spending, saving and generosity.

- Pros:

- Teaches comprehensive money management (Spend, Save, Give)

- Visually engaging and easy for kids to understand

- Durable wood and clear acrylic design

- Encourages goal setting and generosity

- Cons:

- Limited capacity for very large savings goals

- Requires consistent parental guidance for initial setup

- User Impressions: Parents absolutely love this bank for its clear visual division and the concrete lessons it teaches. They report that their children quickly grasp the concepts of budgeting and giving, often becoming more mindful of their spending because they can see their savings grow. It’s seen as a highly effective tool for developing early financial independence.

- See it on Amazon here

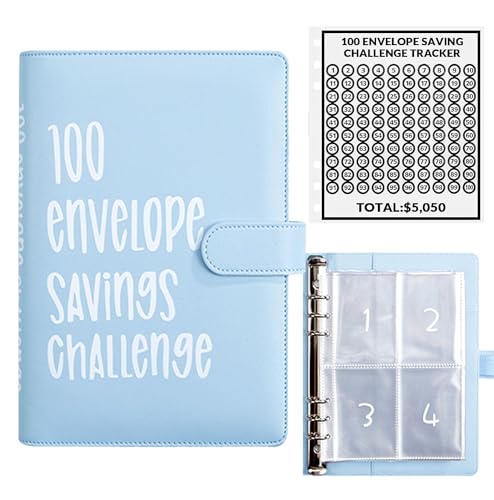

AASLOB 100 Envelopes Money Saving Challenge, 100 Envelope Challenge Binder

For families looking for a structured and engaging way to save, the AASLOB 100 Envelopes Money Saving Challenge is a game-changer. This isn’t just for adults; it’s a fantastic tool for getting the whole family involved in reaching financial goals together. The challenge turns saving into a fun game, making the best way to save for kids an exciting adventure rather than a chore. It’s a hands-on method that concretely demonstrates progress, perfect for teaching kids about setting and achieving financial milestones, whether it’s for a new toy, a family vacation, or future savings.

- Key Features:

- SIMPLE AND FUN:Get the whole family involved in saving with a fun saving challenge that’s also a great tool for teaching kids how to save money. Use this important budget planning tool to help you take control of your finances.

- Premium Material: Budget Book With Cash Envelopes made of soft and durable pvc, it is waterproof and tear resistant. whether it’s files, bills or cash, it can keep them safe. budget binder envelopes for saving money organizer and money budget organizer for cash.

- EASY TO CARRY AND USE:The cash binder is the right size for you to take it anywhere. The transparent inner volume consists of 25 pages. There are 4 card slots on theof each page, a total of 100 card slots. A rich combination of accessories allows you to complete records anytime, anywhere. This is a great budget binder.

- 100 Envelope Challenge Binder: Budget Binder Book makes money saving and budgeting so fun. One for yourself and one for your family budgeting. Help save money for next year! Or as you save money for a vacation, car, emergency fund, debt payoff, birthdays or anything!

- BEST GIFT:100 Envelopes Money Saving Challenge Binder is the best gift for your family, complete the money saving challenge with your family in a more fun way! Whether you’re a kid or an adult, our 100 Envelopes Money Saving Challenge is the perfect tool to help you save money and reach your financial goals.

- Pros:

- Transforms saving into a fun, goal-oriented game

- Encourages family participation and teamwork

- Durable and portable design for on-the-go budgeting

- Visually tracks progress, boosting motivation

- Cons:

- Primarily cash-based, less ideal for digital-only households

- Requires consistent commitment to the challenge

- User Impressions: Users love the interactive nature of this challenge, finding it a highly motivating way to save money for specific goals. Many parents use it to teach their children about long-term saving, making it a tangible and rewarding experience as they watch the envelopes fill up. It’s praised for making budgeting less intimidating and more enjoyable.

- See it on Amazon here

The Whole-Brain Child: 12 Revolutionary Strategies to Nurture Your Child’s Developing Mind

Just like our first two books, “The Whole-Brain Child” offers an indirect but powerful approach to finding the best way to save for kids. Understanding how your child’s brain works – how they process emotions, make decisions, and learn – is fundamental to effective parenting and teaching. This book equips parents with strategies to help children develop emotional intelligence and make thoughtful choices, skills that are directly transferable to financial decision-making. By nurturing a “whole-brain” approach, you’re setting your child up to be more mindful and disciplined, traits essential for smart money management and building future savings.

- Key Features:

- Bantam publisher

- Explores brain development in children

- Offers 12 practical strategies for parenting

- Helps integrate different parts of the brain for better emotional regulation and decision-making

- Pros:

- Enhances parental understanding of child psychology

- Provides actionable strategies for daily interactions

- Promotes emotional intelligence in children

- Creates a foundation for rational decision-making in all areas of life

- Cons:

- Not explicitly a financial education book

- Concepts can be abstract and require thoughtful application

- User Impressions: This book receives widespread acclaim for its insightful approach to child development. Parents appreciate how it helps them respond to their children more effectively and foster essential life skills. Many feel it provides a deeper understanding of their child’s behavior, leading to more patient and productive guidance, even when discussing topics like financial responsibility.

- See it on Amazon here

Trekbest Money Maze Puzzle Box – A Fun Unique Way to Give Gifts, Cash, Gift Cards, Small Items – Fun Gift Game and Novelty Puzzle Box for Kids & Adults

Want to make receiving money or small gifts an educational and fun experience? The Trekbest Money Maze Puzzle Box is a brilliant little gadget that does just that! While it’s often used as a clever gift presentation, it doubles as a cool coin box once the puzzle is solved. This interactive toy teaches kids patience, problem-solving, and the value of a little effort to “earn” their reward. It subtly reinforces the idea that money isn’t just given; sometimes, you have to work for it. It’s a playful yet effective way to introduce kids to the idea of mindful handling of their money, making it a unique addition to the best way to save for kids arsenal.

- Key Features:

- Receiving Gifts is Half the Fun – Combine puzzle game and gift boxe into one with this gift holder puzzle box. It’s a fun and cool way to give a gift.

- Make Them Work for Their Gifts – It’s ideal as unique birthday gifts for the adults and kids in your lives who love brain teasers, or use them as funny gag gifts to make your teenagers to use their ingenuity and logic to get their cash.

- Great for Christmas and Birthdays – Sometimes cash or gift cards can seem like last minute gifts. But when you include a small puzzle box game, suddenly an inexpensive accessory makes your gift special.

- Fun for Kids – These game and toy maze boxes are a challenge for kids, without being too hard to crack or too easy to be boring. Once the puzzles are solved and the gifts are retrieved, they can be used as coin boxes or secret storages.

- Stock Up Now – Recommended age 6 and up. They are great as small gifts for boys, girls, teenagers, and even adults. They are also perfect for small gifts like concert tickets and even jewelry to place.

- Pros:

- Adds an element of fun and challenge to receiving money

- Encourages problem-solving and patience

- Can be reused as a personal coin box or secret storage

- Makes gift-giving more memorable and educational

- Cons:

- Not a primary savings account or financial education tool

- Might be frustrating for very young children

- User Impressions: Customers love the novelty and challenge of the Money Maze. Many report that it’s a hit with kids and teens, adding an extra layer of excitement to gifts. Parents appreciate that it teaches a mini-lesson in delayed gratification and critical thinking, turning a simple cash gift into an engaging activity.

- See it on Amazon here

Beyond the Tools: Practical Tips for Parents

While these products offer fantastic starting points, remember that your involvement is the most powerful tool. Here are a few extra tips for nurturing financial literacy in your kids:

- Lead by Example: Kids are always watching! Show them your own smart money habits. Talk about your family’s budgeting, saving for goals, and even making responsible spending choices.

- Allowance with Purpose: Tie allowance to responsibilities, not just age. Help them divide it into “Spend,” “Save,” and “Give” categories from the start.

- Set Clear Goals: Whether it’s saving for a new video game or a special outing, help your kids define what they’re saving for. This makes the effort more tangible and rewarding.

- Make it Fun! Turn saving into a game. Create challenges, offer matching contributions for their savings, or celebrate when they reach a goal.

- Talk Openly About Money: Demystify money. Explain why things cost what they do, why we save, and why giving back is important.

FAQ: Your Questions About Kids’ Savings Answered

Q1: When is the best time to start teaching kids about money?

A: It’s never too early! You can start with basic concepts around age 3-4 by teaching them about wants vs. needs, or by using a simple piggy bank. More structured lessons like allowance and goal-setting can begin around ages 5-7.

Q2: What’s the difference between saving and investing for kids?

A: Saving is putting money aside for future use, usually in a low-risk account like a savings account, where it earns minimal interest. Investing is putting money into assets like stocks or mutual funds with the goal of significant growth over time, but it carries more risk. It’s often best to teach saving first, then introduce investing concepts as they get older (teen years).

Q3: Should I give my child an allowance?

A: Many financial experts recommend an allowance as a tool to teach money management. It gives children practice in budgeting, making choices, and experiencing the consequences of their spending. Whether it’s tied to chores or given unconditionally is a personal family choice.

Q4: How can I make saving fun for my kids?

A: Turn it into a game! Use charts to track progress, set exciting goals, offer to match their savings for specific milestones, or even use interactive tools like the “100 Envelopes Money Saving Challenge” to keep them engaged.

Q5: What are common mistakes parents make when teaching kids about money?

A: Common mistakes include not talking about money at all, shielding kids from financial realities, bailing them out every time they overspend, or not being consistent with allowance or consequences. Overly complex explanations for young children can also be counterproductive.

Q6: How do I choose the right saving tool for my child?

A: Consider your child’s age, personality, and your family’s financial habits. For younger kids, a physical piggy bank (like the Mczxon Give Save Spend box) is great. For older kids, a savings account at a bank, or even a basic investment account (with parental guidance) might be more appropriate. Educational books are great for all ages.

Q7: How can I lead by example in saving?

A: Be transparent (age-appropriately) about your own saving habits. Let them see you contribute to your emergency fund, save for a family vacation, or comparison shop. Talk about financial decisions you make and why you make them, showing them that smart money management is a lifelong skill.

Ready to Empower Your Child’s Financial Future?

Finding the best way to save for kids isn’t about a single magic bullet; it’s about a holistic approach that blends education, practical tools, and consistent guidance. By using resources like the ones we’ve explored, alongside open communication and your own positive example, you’re not just helping them save a few bucks – you’re building a foundation for a financially secure and responsible future. So go ahead, pick a tool, start a conversation, and watch your child grow into a smart money manager!